Cash Balance Plans are a type of tax-qualified Defined Benefit Pension Plan that looks a lot like a profit-sharing plan. They have increased in popularity in recent years for a number of reasons.

Would You Rather

Pay Yourself Or The IRS?

What Is A

Cash Balance plan?

Tax Benefit

Contributions to the plan are tax deductible and investment return is tax deferred.

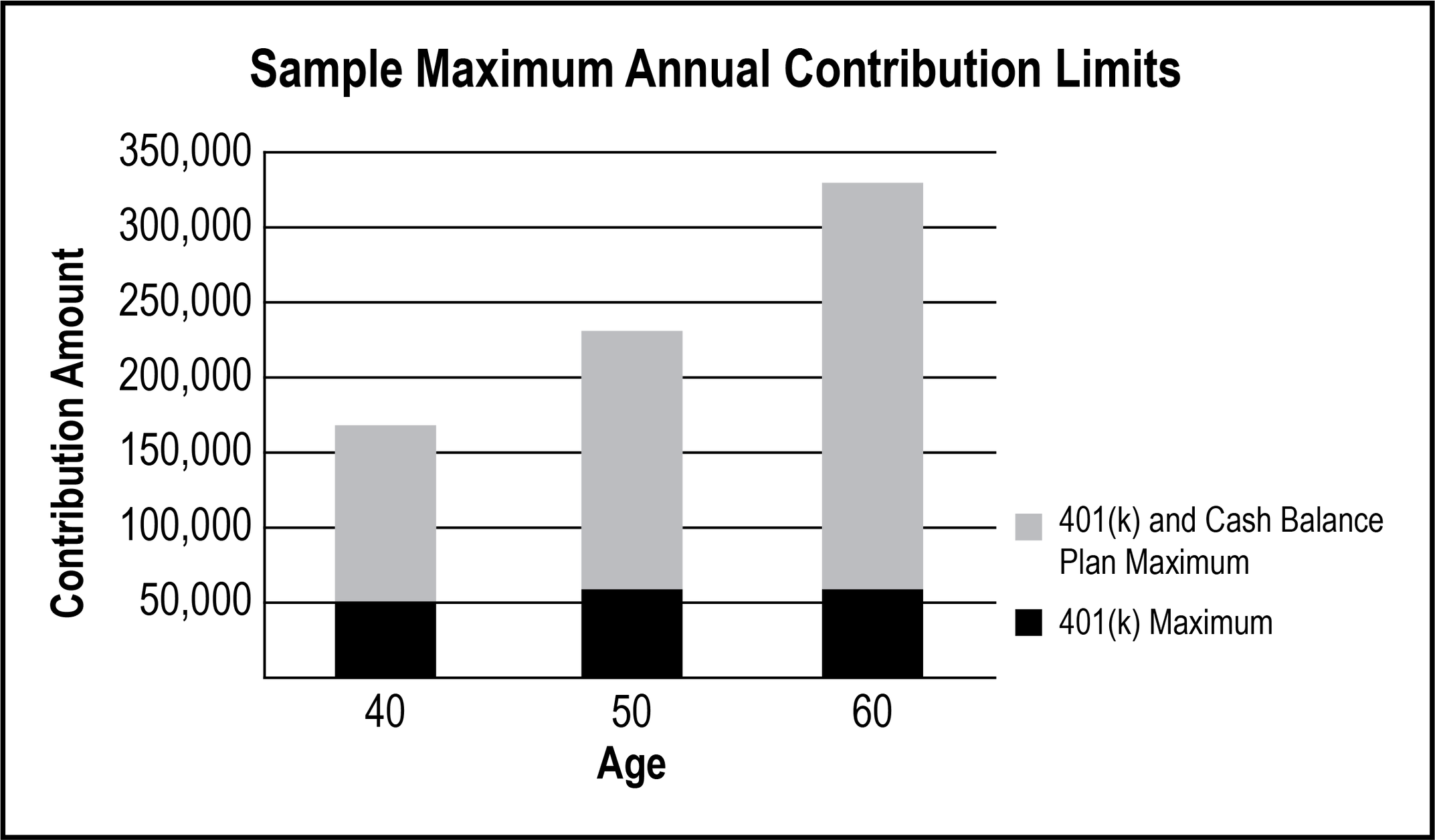

Higher Contribution Limits

Cash Balance Plans permit larger annual tax-deductible contributions and benefits than are possible with a 401(k) Profit Sharing Plan.

Flexible Design

Cash Balance Plans can easily be designed to provide age neutral benefits to all employees or targeted allocation to specific individuals

Easy To Understand

Cash Balance Plans are easier for plan sponsors and participants to understand than traditional Defined Benefit Plans.

Work With 401(K) Plan

Cash Balance Plans do not require substantial changes to existing 401(k) Profit Sharing Plans to work well in tandem with 401(k) Profit Sharing Plans.

Cash Balance Plan

Features

Benefits Defined In A Plan Document

Plan document provides for annual allocation and interest credit.

Interest crediting rate is usually a fixed rate between 3% and 5%. Some Cash Balance Plans now utilize a return based or market-based index. However, a low fixed interest crediting rate is much preferred due to concerns with reducing the maximum lump sum benefit limit and employee contribution cost increase based upon the use of market-based interest crediting.

Total value of plan assets is usually different than total value of Cash Balance benefits.

Are You A Good Candidate

FOR A CASH BALANCE PLAN?

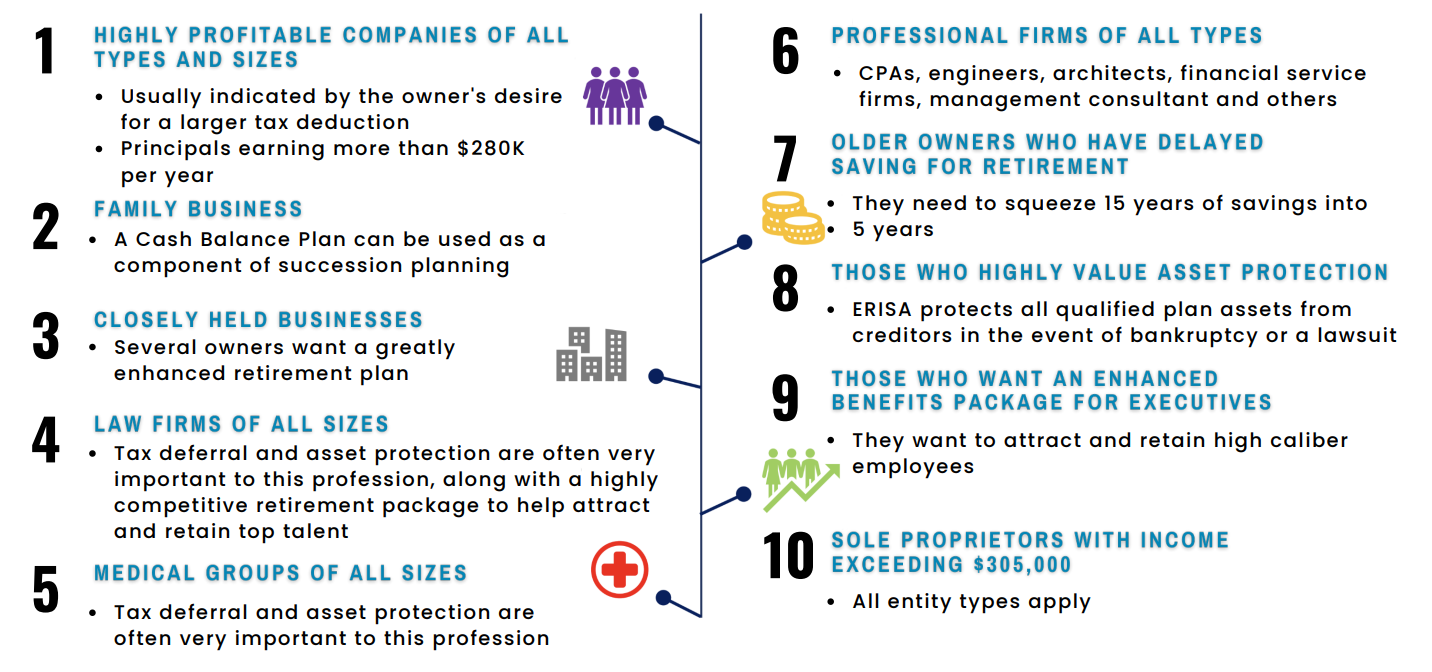

Many partners and professionals find Cash Balance Plans an excellent way to increase contributions to their retirement accounts. After designing over 1,000 Cash Balance Plans, we have found that the following are typically good candidates

What Should You Consider?

Attributes of

Cash balance candidates

Can Cash Balance Contributions Change From Year To Year?

Ready to Get Started? Get in Touch

Cash Balance Plann

Many partners and professionals find Cash Balance Plans to be an excellent way to increase contributions to their retirement accounts. After designing over 1,000 of these plans, we have found that the following are typically good candidates.